10 Simple Ways to Build a Monthly Budget That Works

Creating a monthly budget is one of the most effective ways to manage your finances, reduce stress, and reach your financial goals. Whether you’re trying to save for a big purchase, pay off debt, or simply take control of your money, a well-structured budget can make all the difference. Here are 10 simple ways to build a monthly budget that works.

1. Track Your Income

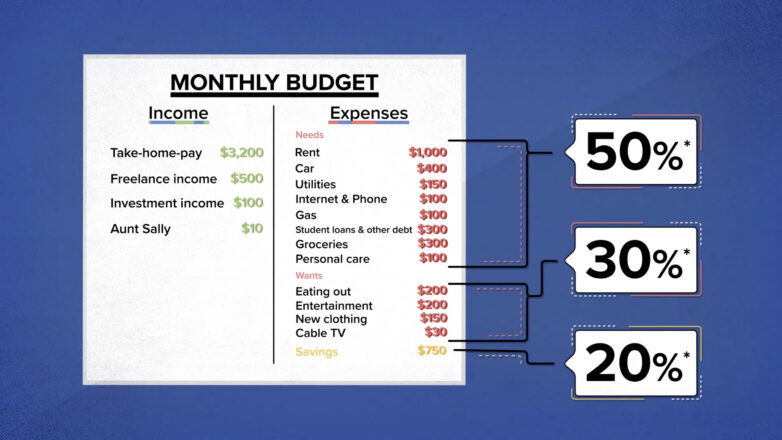

The first step in building a budget is knowing exactly how much money you have coming in each month. Include all sources of income, such as your salary, side hustles, freelance work, and any passive income streams. Accurate income tracking is the foundation of a successful budget.

2. List All Your Expenses

Make a list of all your monthly expenses, including rent or mortgage, utilities, groceries, transportation, insurance, entertainment, and debt payments. Don’t forget irregular expenses like annual subscriptions or car maintenance. Understanding where your money goes is key to budgeting effectively.

3. Categorize Your Spending

Divide your expenses into categories such as needs, wants, and savings. Needs include essentials like food, housing, and utilities, while wants are non-essential items like dining out, entertainment, and shopping. Savings and debt repayment should also have a dedicated category.

4. Set Realistic Goals

Set clear, achievable financial goals. This could be paying off a credit card, saving for a vacation, or building an emergency fund. Goals help guide your budgeting decisions and keep you motivated to stick to your plan.

5. Choose a Budgeting Method

There are several budgeting methods you can use, including:

- 50/30/20 Rule: 50% of income to needs, 30% to wants, 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of income to a specific expense or savings goal.

- Envelope System: Use cash in envelopes for different spending categories to avoid overspending.

Pick the method that suits your lifestyle best.

6. Automate Savings and Bills

Automating payments for bills and savings ensures you never miss a due date and keeps your savings on track. Set up automatic transfers to your savings account and schedule bill payments to reduce financial stress.

7. Review and Adjust Regularly

Your budget is not set in stone. Review your budget at the end of each month to see where you overspent or saved more than expected. Adjust your categories and goals to reflect your actual financial situation.

8. Cut Unnecessary Expenses

Identify areas where you can cut back. This might include subscription services you rarely use, dining out too often, or impulsive shopping. Reducing unnecessary expenses frees up money for savings and debt repayment.

9. Use Budgeting Tools and Apps

Budgeting apps can make the process easier and more efficient. Tools like Mint, YNAB (You Need A Budget), or PocketGuard help track spending, categorize expenses, and provide visual insights into your financial health.

10. Stay Consistent and Patient

Building a budget that works takes time and discipline. Stay consistent with tracking, reviewing, and adjusting your budget. Over time, you’ll develop better financial habits and see meaningful progress toward your goals.

Conclusion

A monthly budget is more than just numbers; it’s a roadmap to financial freedom. By following these 10 simple ways to build a monthly budget that works, you can take control of your finances, reduce stress, and achieve your financial dreams. Start today, and remember, consistency is key!